rhode island state tax rate 2020

Find your pretax deductions including 401K flexible account. About Toggle child menu.

1040 2020 Internal Revenue Service Internal Revenue Service Worksheets Instruction

The table below displays the state.

. How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table. For married taxpayers living and working in the state of Rhode Island. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. Rhode Islands state sales tax was 700 percent in 2017. The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7.

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. 599 on taxable income over 150550 For 2022 the 375 rate applies to the first. Tax Schedule F with rates ranging from 09 percent to 94 percent was in effect in calendar year 2020.

Ad Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now. Complete Edit or Print Tax Forms Instantly. Rhode Islands income tax brackets were last changed.

Rhode Island reduced its corporate income tax rate for C corporations from 9 to 7 as of January 1 2015. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. 375 on up to 66200 of taxable income High.

Both the state income and sales taxes are near national averages. Find your income exemptions. Single Tax Brackets Married Filing Jointly Tax Brackets For earnings between 000 and 6525000 youll pay.

State of Rhode Island Division of Taxation 2022 RI-1065. Rhode Island also has a 700 percent corporate income tax rate. Rhode Island Tax Brackets for Tax Year 2020 Tax Rate Income Range Taxes Due 375 0 to 65250 375 of Income 475 65250 to 148350 244688 475 599 148350.

Rhode Island Corporate Income Tax Comparison A home business grossing. Check if a Jobs Growth Tax is being reported on line 7b. Groceries clothing and prescription drugs are exempt from the Rhode Island sales tax.

The average effective property tax rate in Rhode Island is the 10th-highest in the country though. Rhode Island has a. The state did not levy any local sales taxes meaning that the total sales tax was 700 percent.

Everything You Need to Know - SmartAsset The Rhode Island estate tax rates range from 0 to 16 and applies to estates valued at 1537656 and. State of Rhode Island Division of Municipal Finance Department of Revenue. Rhode Island Income Tax Range.

The UI taxable wage base will be 24600 for most employers and 26100 for employers. Tax rate of 475 on taxable income between. Ad Access Tax Forms.

Rhode Island collects a state income tax at a maximum marginal tax rate of spread across tax brackets. The chart below breaks down the Rhode Island tax brackets using this model. Ad Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now.

Rhode Island Estate Tax. State of Rhode Island Division of Taxation 2022 RI-1065. Unlike the Federal Income Tax Rhode Islands state income tax does not provide.

26100 for those employers that have an experience rate of 959 or higher Employers will be notified in. Tax rate of 375 on the first 68200 of taxable income.

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

These States Have The Highest And Lowest Tax Burdens

State Income Tax Rates Highest Lowest 2021 Changes

/images/2022/01/18/individual-tax-rates-by-state.png)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

State Corporate Income Tax Rates And Brackets Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Visualizing Unequal State Tax Burdens Across Maps On The Web State Tax Finance Function Tax

Sales Tax By State Is Saas Taxable Taxjar

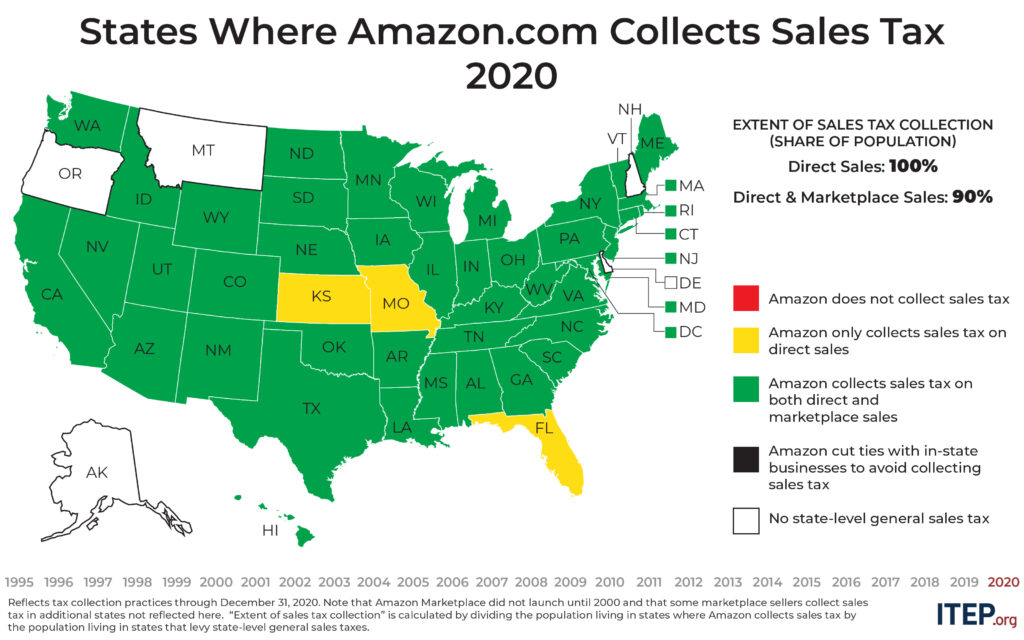

A Visual History Of Sales Tax Collection At Amazon Com Itep

1040 2020 Internal Revenue Service Internal Revenue Service Worksheets Instruction

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Least Tax Friendly States For Retirees American History Timeline States And Capitals Funny Retirement Gifts

State Corporate Income Tax Rates And Brackets Tax Foundation

Best Examples Of Data Journalism And Computational Journalism Projects Around Tax Data Journalism Journalism Data